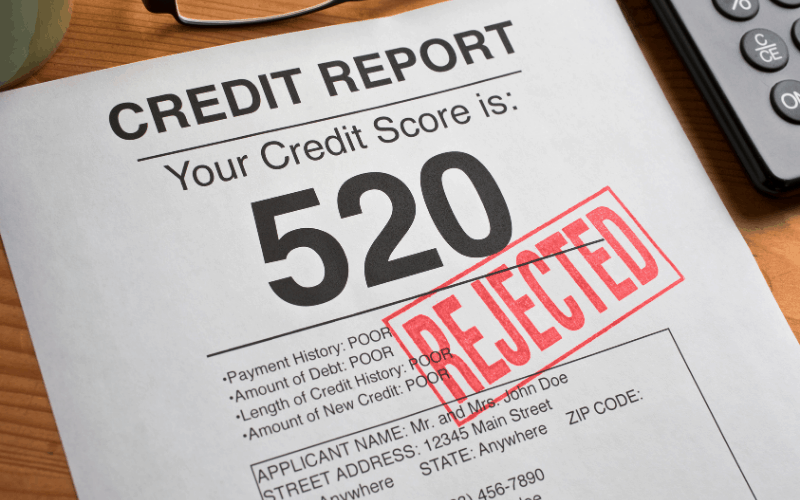

Having bad credit can really wreak havoc in your life. Your credit score is used for everything from renting an apartment to getting a cell phone. Having bad credit can even keep you from getting certain jobs.

When your credit is bad you pay more for the things that you want and need. You’re forced to pay high-security deposits and super high-interest rates. And in many cases, you are just plain denied.

Chances are you have no idea what your credit score is. But you applied for an apartment, store card, or had to pay a large deposit for utilities or a cell phone which alerted you to the fact that your credit score is bad.

Or you might be well aware that your credit score is bad because life has happened and certain things have caused your credit score to plummet. You have a pretty good idea that it’s bad but you don’t know the actual number.

If you know that you credit is bad, this post discusses 5 things you should do now to raise your credit score.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Credit Hope Repair

This blog post is sponsored by the Credit Hope Repair Team. They have provided the tips in this post to help you fix your credit.

Fixing your credit is something you can definitely do yourself. With research, time, and effort you can get your credit back on track.

However, if you would like to leave it to professionals that have a proven track record in credit repair then give Credit Hope Repair a try. The credit repair sisters can do all the heavy lifting for you and help you leave bad credit in the rearview mirror.

Find our more about Credit Hope Repair Here.

#1 Order A Free Credit Report

Getting a copy of your credit report is the first step to rebuilding your credit. You can’t put together a personalize strategy to rebuild your credit until you know exactly what you’re working with.

There is no need to purchase your credit report. You can get a free copy of your credit report from each credit reporting company every 12 months.

Simply go to AnnualCreditReport.com and request your free credit reports.

#2 Clean Up Your Name & Address

Now that you have your credit report it’s time to start cleaning things up. Cleaning up the name and address portion of your credit report is an often overlooked step in credit repair.

Carrying incorrect name variations and addresses can inadvertently cause your credit score to decrease. For this reason it is a good idea to ensure that your name and address are properly represented on your credit report.

If you notice discrepancies, you can send a letter to the credit reporting agency requesting that they correct your information. The Credit Hope Repair Team has provided a copy of a free letter that you can use to send to each credit repair agency to clean up your name and address.

#3 Freeze Your Information

Most people only know about the three major credit reporting agencies Equifax, TransUnion, and Experian. In the background, there are lesser-known companies that have databases that hold trillions of records about people.

These companies are data aggregators. They are what credit bureaus use to verify your information. Freezing your information with data aggregators can help with repairing your credit.

Here are a few data aggregators that you can contact to freeze your information:

1) LexisNexis – 1-800-831-2578 – You can say you would like to opt-out of disclosing future information including the clue report/freeze my account)

2) Innovis – https://www.innovis.com/securityFreeze/index or 1-800-540-2505 – request a security freeze

3) Sagestream – https://forms.sagestreamllc.com/#/freeze-self

#4 Dispute Inaccuracies

After your information has been frozen with the data aggregators, it’s time to dispute inaccuracies. Research has shown that 79% of credit reports are inaccurate.

Review your credit report and dispute anything that is not 100% correct. Anything that can not be proven to be correct must be removed from your credit report.

The Credit Hope Repair team recommends that you always dispute inaccuracies via a letter and never use the online tools that are provided by the credit agencies.

#5 Reduce Your Utilization

The five major factors have an influence on your FICO credit score, the most commonly used credit scoring model, are:

Payment history (35%)

Level of debt/credit utilization (30%)

The age of credit (15%)

Mix of credit (10%)

Credit utilization is the ratio of your outstanding credit card balances to your credit card limits. It measures the amount of available credit you are using.

For example, if your balance is $300 and your credit limit is $1,000, then your credit utilization for that credit card is 30%.

To calculate your credit utilization ratio, simply divide your credit card balance by your credit limit, then multiply by 100. Your Credit Utilization should be under 30% (experts recommend 20%)

As I mentioned earlier Utilization accounts for 30% of your credit score

To see a substantial boost in your credit score get your utilization under 10 – 15% for all of your credit cards.

Hi These are great tips.