If you dread tax season every year, it’s time to change that narrative. There is no reason to be stressed, worried or dreading tax time each year.

It’s not good for your mental health, or physical health, either, to be stressed out. The reason you probably feel this way is that you have not taken the time to be organized throughout the year.

However, with just a little bit of preparation, and by utilizing a simple system throughout the year, you can regain control of your emotions and make tax time a cinch.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Ways to Stay Organized for Tax Season

There are basic components you will need for tax season- receipts of payments (think receipts and paid invoices) and records of payments (think bank and credit card statements).

If you have a system for filing and obtaining these items, you’re 90% done with tax prep. For receipts of payments, you need a file for invoices and receipts you pay throughout the year.

This system can be whatever works best for you.

Where to Store Tax Documents

Best Way to Organize Paper Files

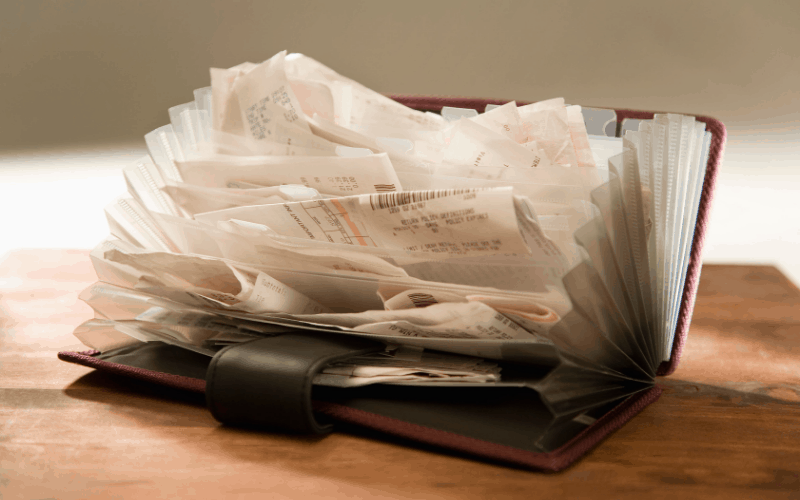

Some people prefer keeping a physical paper trail. For physical paid invoices and receipts, you need a physical filing system that works for you.

Something like an accordion-style file folder would work just fine, or a filing cabinet with folders, if you tend to have larger volumes.

How you file your receipts and invoices is up to you. There is no wrong system as long as you keep them organized and you know where to find them when you need them.

Standard filing practices include categories by month, vendor name, or expense category.

Best Way to Organize Receipts Electronically

If you have a software system for bookkeeping, the application often has a mechanism for attaching receipts directly to the payment inside of the program. You can attach pdf or jpeg images to the payment for easy reference.

Alternately, you can set up a filing system in files on your PC, similarly to the paper files above. You can save receipts and paid invoices to this file.

How to Organize Tax Documents for Your Accountant

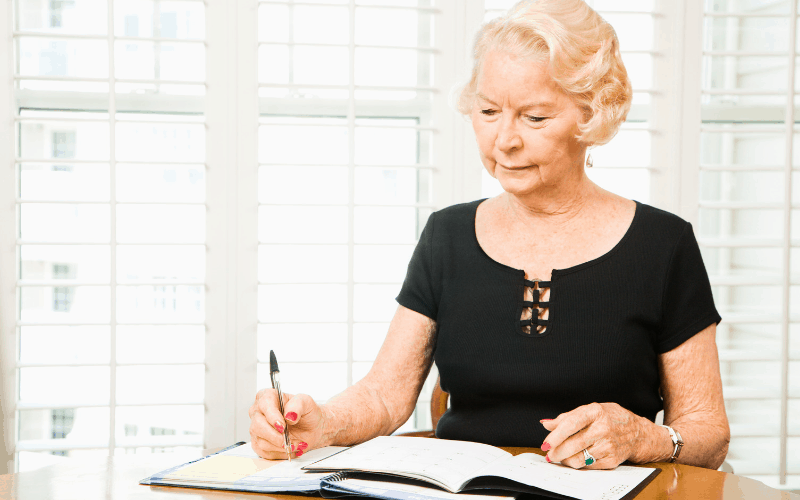

Paper Tracking – Tax Organization Worksheets

If you prefer managing your finances on paper (rather than a software bookkeeping system) you will want a way to track your expenses so you don’t have to spend hours at tax time adding up the totals.

Tax organization worksheets will allow you to keep track of all documents needed for tax season. They allow you to stay organized and prepared for your accountant.

Whatever you use, at the end of each month,

You will only need the receipts for an audit, but you will need your totals so you can calculate your annual expenses at tax filing.

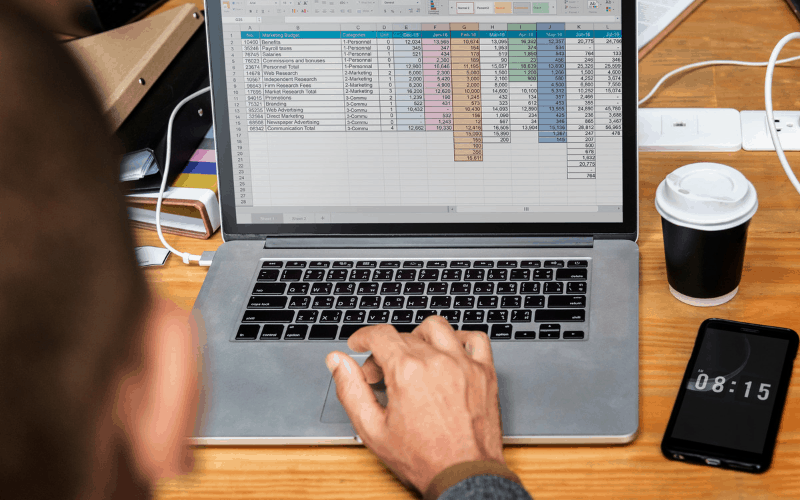

Electronic Tracking – Accounting Software

The easiest form of any type of electronic bookkeeping system is accounting software. However, for those who are on a budget, this may not be feasible.

You can use a basic spreadsheet in Excel or a similar program to track expenses. Again, you will need just the annual totals for your tax filings. But it is recommended that you track these monthly for easy tax tracking.

For records of payments, you will need a file. You can use either electronic files or paper files. You will need to store your bank and credit statements that you will also need at tax time. Ideally, you should attach your reconciliations to each statement.

Have a Stress-free Tax Season

Following these easy steps, you can breeze right through tax time, stress-free. By using these ways to stay organized for tax season

Knowing where to store tax documents, how to use tax organization worksheets, and the best way to organize receipts electronically will help make tax season a breeze.

Leave a comment and share how you stay organized during tax time.

Don’t forget to Like, Share, Tweet, and Pin this post.