Zero Based budgeting is an excellent budgeting method that ensures that every dollar has a purpose. Incorporating cash envelopes can allow you to easily keep track of your money and ensure that you stick to your planned budgeted amounts in each of your budget categories.

If you are a fan of the Dave Ramsey budget and you like working with cash then chances are you’ll love the cash envelope system.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

What Are Cash Envelopes

Cash envelopes or money envelopes are simply envelopes that are used for the specific purpose of holding cash. They are used in the cash envelope system to house cash for each of your budget categories. They can also be used to house cash for your sinking funds.

Types of Cash Envelopes

There are a variety of types of cash envelopes. You can use standard white or brown envelopes or you can spice things up by using specialized envelopes designed specifically for budgeting.

If you enjoy doing DIY projects, then you can use printable cash envelopes or make your own laminated cash envelopes. You can also grab pre-made laminated cash envelopes in a variety of patterns and designs so you can focus on setting up your budgeting.

There are also clear cash envelopes available if your style is more minimalistic.

Most cash envelopes are designed so you can use them on the go. They normally will fit into a cash envelopes wallet or your favorite planner.

Benefits of Using Cash Envelopes

Managing your money in cash can provide many benefits. Seeing your money in cash makes it real and not something virtual that you manage using your cell phone or computer.

Using money envelopes can also help you stay on track with your budgeting. You know exactly how much money you have to spend. When the money in your envelopes is gone you are not able to spend any more money. This keeps you from overspending and using credit.

Envelope budgeting can also help you control your spending. You may be less likely to spend cash as you are more aware of how much money you have left because you can see it. This goes back to you having physical money that you are spending instead of swiping your debit card.

Cons of Using Cash Envelopes

There is no perfect budgeting system therefore there are some drawbacks to using cash envelopes. The first con is that you have to go to the bank after each payday to withdraw cash. This is slightly inconvenient as you might have direct deposit which doesn’t require visiting a bank to cash your check.

Another potential con of using money envelopes is that you often be in a position where you are carrying large amounts of cash. This can be a little unnerving however it can be remedied by not carrying all of your cash envelopes around with you at once.

For example, if you are going grocery shopping, there is no need to carry your date night or your savings envelopes with you. You might, however, want to carry your beauty or your transportation envelopes with you because you could need them at any time.

Using cash budgeting can also be inconvenient when it comes to paying bills online or shopping online. If you find this to be a major drawback you can implement a partial cash budgeting system. This would consist of leaving the money that you would use to pay online bills in your checking account and only withdrawing cash for your other budget categories.

Not having an excessive amount of money available to shop online might help you with spending less. However, there can be a need to do some shopping online. Especially when you can find some things cheaper from places like Amazon. For cases like this you may choose to leave a portion of your money for certain budget categories in your bank account.

How Do Cash Envelopes Work

In the cash envelope system, cash envelopes are designed to hold cash that you have separated into different budgeting categories.

Lets did a little deeper into how cash envelopes are used for budgeting.

Dave Ramsey Budget

To get a clear understanding of budgeting with cash envelopes we can start with the Dave Ramsey Budget. This type of budget is also call the zero based budget.

In this type of budget, you account for all of your money by assigning it to specific budget categories to be used for specific purposes. Your budget is not complete until your income minus your expenses are equal to zero.

You can find out how to create a budget using this method in detail in this article. It includes a free zero based budget spreadsheet that you can download to create your budget.

The use of cash envelopes start after you have created your zero based budget.

Cash Envelope System Explained

Once you have your budget created you are ready to begin using the cash envelope system. The beauty of the cash envelope system is that it keeps you from overspending and you can easily see when you can no longer spend money.

Step 1: The first step of using the cash envelope system is creating your budget and determining your budget categories. We covered this step in the previous section of this article.

You should also consider adding sinking funds to your budget to ensure you do not have to pull money from other budget categories for large expenses.

Step 2: Your next step is to set up your cash envelopes. You will need a cash envelope for each of the budget categories that you set up in step 1.

As I mentioned earlier you can use regular envelopes, make your own envelopes, or purchase pre-made cash envelopes. Budgeting can sometimes be pretty boring so using pretty laminated cash envelopes and labels can make the process a little more fun and enjoyable.

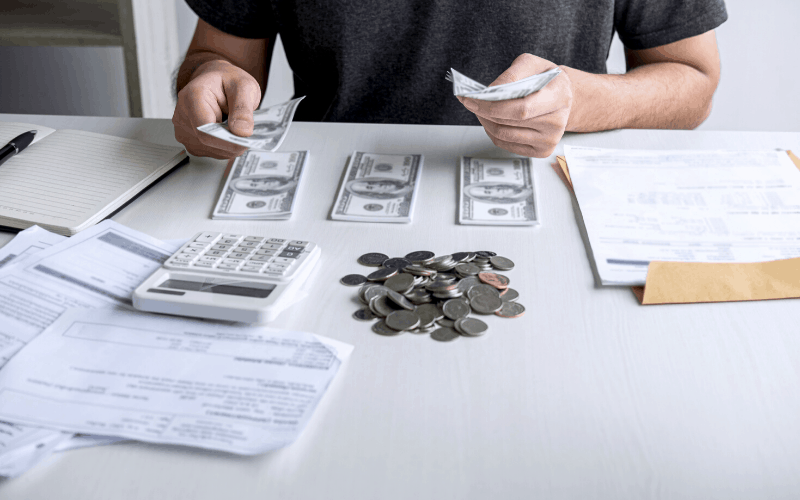

Step 3: Now that you have your envelopes picked out and labeled it’s time to start stuffing your envelopes. Each month after you complete your budget you will add the pre-determined amount of money into each of your envelopes.

You will need to stuff your envelopes each time you get a paycheck. If you utilize this budget spreadsheet you can easily budget by paycheck and know exactly how much you should put into each envelope after each paycheck.

Step 4: As you move through the month pay all of your expenses from the appropriate cash envelope. When you run out of money in an envelope your spending is done. You should not pull money from other envelopes to continue spending.

For example, if you have a Beauty category in your budget and you allot $100 for that category. After you spend the $100 in your beauty cash envelope you will have to wait until the next month to make any beauty purchases.

This is designed to keep you from overspending.

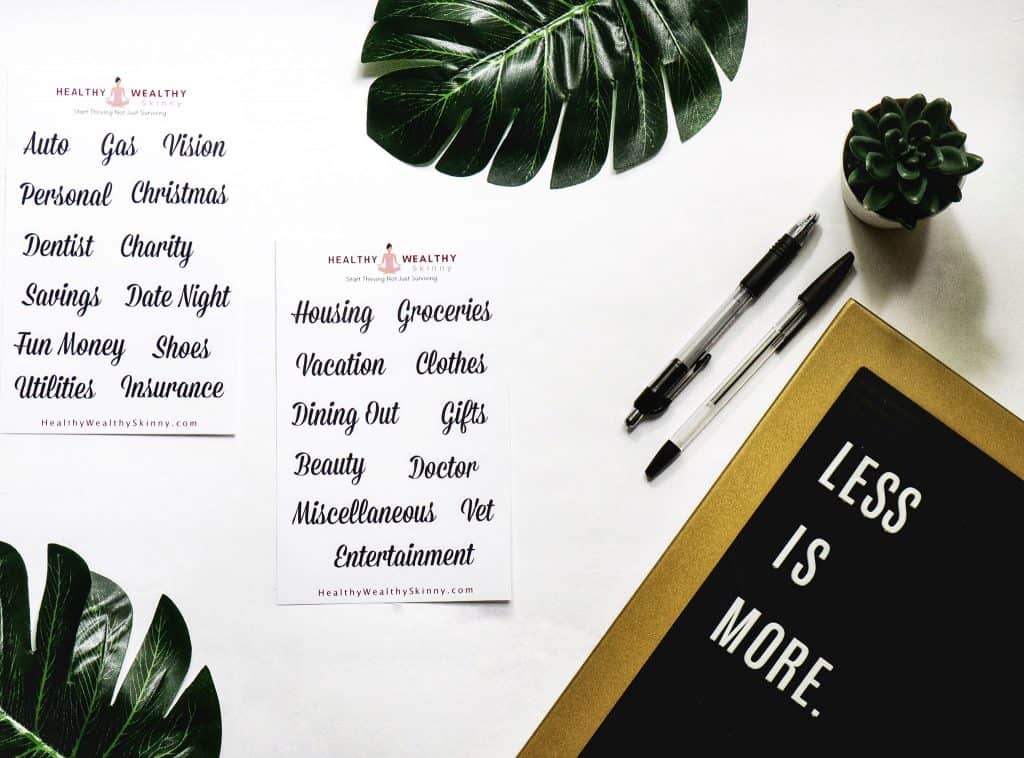

Cash Envelope Categories

When initially getting starting using cash envelopes it might be difficult to determine your cash envelope categories. They should be personal to you and your spending habits.

If you are new to budgeting, I recommend tracking your spending. You can do this by using your bank statements or by using an expense tracker.

Once you have a clear understanding of your required expenses it will be a lot easier to determine your budget categories.

Dave Ramsey Budget Categories

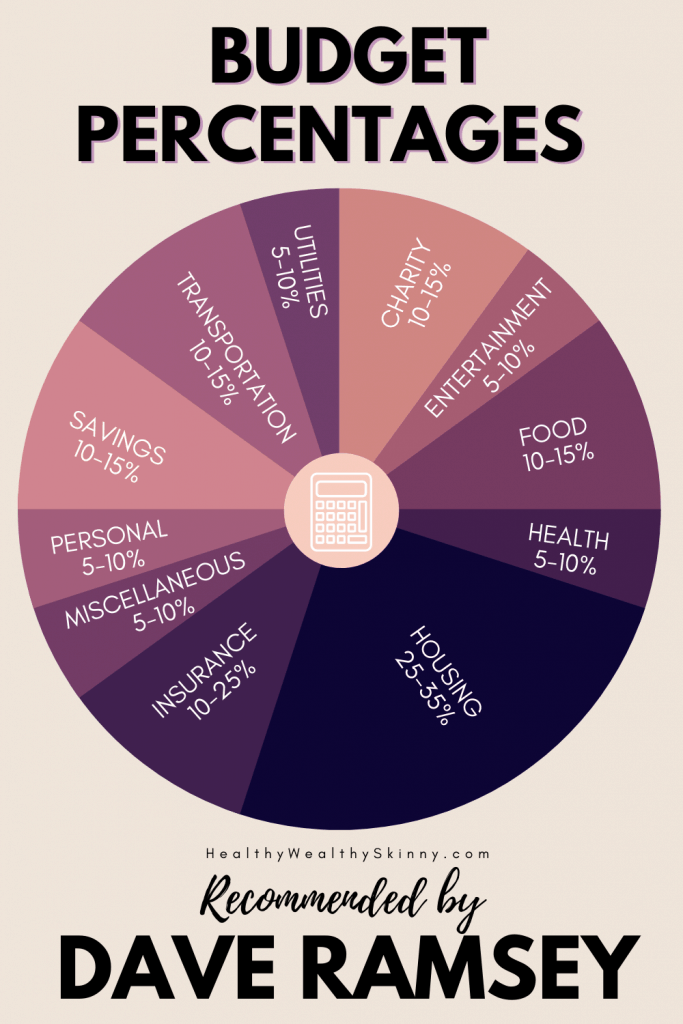

For those that are looking for more guidance with their budget categories you can use suggestions by Dave Ramsey. Here are Dave’s suggested household budget categories.

- Charity

- Entertainment

- Food

- Health

- Housing

- Insurance

- Miscellaneous

- Personal

- Savings

- Transportation

- Utilities

Don’t forget to Like, Share, Tweet, and Pin this post.