Sharing finances is difficult for any couple, becoming even more troublesome for unmarried couples. Being devoid of marriage’s legal shield, non-married couples must choose to manage their money together cautiously.

The most important thing is dealing with money in a manner that creates expectations that maintain financial priorities and build trust. This article explains the best ways unmarried people can share their finances.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Discuss Your Financial Values and Priorities

Before making any financial decisions together, unmarried couples should have an open discussion about their views on money. Understand each other’s financial values, priorities, and goals first.

For instance, does one partner believe in saving aggressively for the future while the other prefers indulging today? Is one partner entering into the relationship with significant assets or debts? Making sure you see eye-to-eye on big-picture money values prevents conflicts when dealing with day-to-day finances.

Part of this conversation is setting shared financial goals as a couple. Do you hope to buy a home together someday or take luxury vacations annually? Establishing aligned priorities for how you want to spend and save money helps guide your joint financial decisions.

Recognizing differences and finding compromise is key. For example, if one partner wants to aggressively pay down student loan debt while the other wants to invest surplus income in the stock market, you could aim to do both simultaneously.

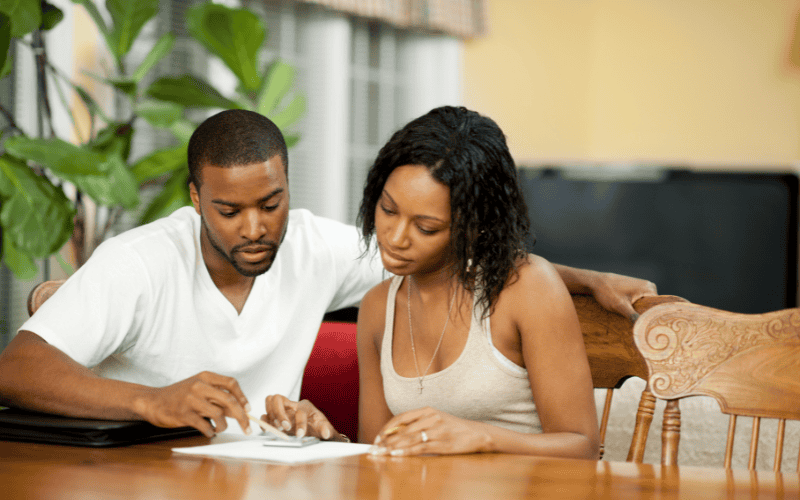

Maintain Transparency Around Income, Expenses, Assets and Debts

Financial openness and honesty are critical for unmarried couples sharing finances. While it can feel vulnerable, being transparent about your full financial picture allows informed joint decision-making.

Before moving in together or mingling money, share details on your income, savings, investments, debts, credit score, and any other financial resources or obligations. Maintain ongoing transparency by keeping your partner in the loop on major purchases, raises at work, job changes, or any factors impacting your finances.

Also, set expectations for how you’ll continue sharing financial details as a couple. For instance, will you share passwords to financial accounts or credit reports? How often will you have check-ins about your respective incomes and spending? Establishing habits of financial transparency early prevents distrust.

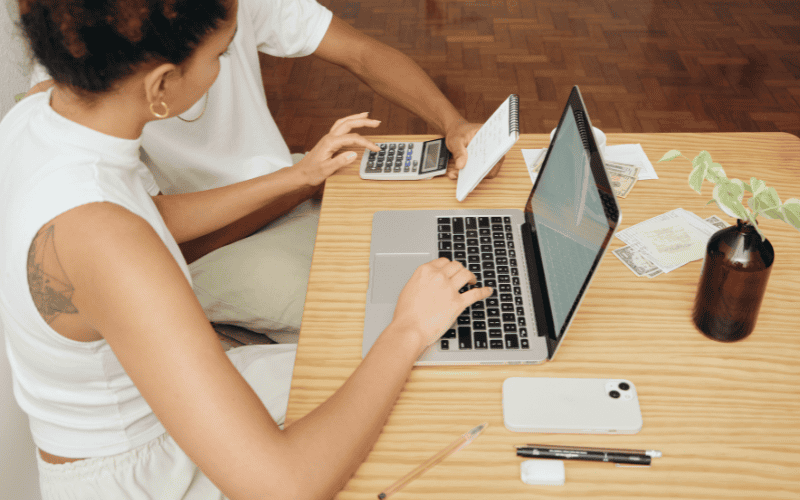

Create a Joint Budget

A budget is a cornerstone of any healthy financial relationship. As an unmarried couple, take time to create a monthly shared budget outlining joint income, savings goals, fixed costs, and discretionary spending.

First, determine what percentage of individual incomes each of you will contribute towards shared expenses vs keeping separate. Some couples contribute proportionally to their respective incomes, while others split shared costs 50/50.

Next, list out all joint expenses the budget needs to cover like rent, groceries, utilities, transportation, entertainment, travel, etc. Don’t forget to include savings goals for the future too like an emergency fund, retirement accounts, or other big purchases.

Moreover, allocate estimated amounts for each budget category. Having an agreed-upon budget prevents future arguments about overspending and ensures you’re working towards shared priorities. Revisit the budget monthly and adjust as needed.

Use Hybrid Strategy

A hybrid strategy of financial sharing may be a compromise for some unmarried couples. This comprises keeping separate accounts to cater for personal expenses and optional purchasing, as well as having a common account for shared expenses e.g., rent, utilities, and groceries.

Through a hybrid approach, partners can have the advantage of both apart and combined funds. They retain their financial freedom but at the same time strive towards achieving joint goals.

Such an arrangement is useful especially when one partner has different spending habits or financial objectives than the other because they can handle their own finances while still contributing to the household budget.

It is a must to set clear rules concerning the payment and administration of the shared account while implementing a blended approach. In addition, husband and wife should often revisit their economic conditions so as to confirm they still suit their desires and ambitions.

Define Financial Boundaries

While unmarried couples share finances, it’s healthy to maintain some financial independence and privacy. Discuss boundaries around what remains separate vs shared. Many couples keep individual discretionary spending, pre-existing debts, and retirement accounts separate.

Agree on limits for personal purchases that require consultation vs pre-approval from a partner. For instance, discuss purchases above $100 or $500 with each other first. Respect each other’s financial boundaries once defined.

Additionally, unmarried couples need to consider who will be responsible for joint debts should a breakup occur. While not romantic, a cohabitation agreement outlines financial rights and obligations to protect both parties.

Choose the Right Financial Tools

To easily manage shared finances, leverage helpful tools and accounts:

- Joint checking account – Open a shared checking account at an agreed-upon bank to pay for joint expenses like rent and utilities. Set expectations for contributing a percentage of income.

- Budgeting apps – Use budgeting apps or spreadsheets to track joint income, expenses, savings, and debt payments. Mint, You Need a Budget (YNAB), and EveryDollar are popular choices.

- Shared credit card – Open a joint credit card to pay for common expenses like groceries, dining out, and entertainment. This simplifies splitting shared costs.

- Communication apps – Manage shared finances seamlessly by linking financial accounts to apps like HoneyFi that improve visibility, coordination, and accountability.

Revisit and Revise Regularly

An unmarried couple’s financial needs and goals evolve over time, so your money management approach can’t remain static. Set reminders to review your budget, financial goals, account structures, and boundaries every 3-6 months.

Check in on what’s working well and identify any pain points to address. As you grow more serious, your financial mixing should reflect your commitment level. Revisit your cohabitation agreement if needed. The key is aligning your financial partnership with the stage of your relationship.

Conclusion

For unmarried couples to merge financial matters with honesty and clarity, they should have open talks, reconcile, and define their expectations.

An effective way to create a sound economic base for unmarried partners is by being truthful, making budgets as a couple, splitting some bills, applying useful technologies, and revisiting their strategies regularly.

Finally, always communicate and approach money choices as a unit. All married couples or any other types of unions will eventually come to terms with each other regarding money management by building trust and working together.