Saving money that you don’t have sounds impossible.

If you are really broke you are focused on basic necessities such as shelter, food, and transportation to your job. After taking care of these items you may feel that there is nothing left to save.

But there are a few ways to start saving money and reverse your financial situation. In this post, I will reveal how to save money when you’re broke.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

6 Things You Should Be Doing If You’re Broke

There are a number of things you should be doing if you’re broke and saving money is high on the list. Check out the video below for a complete list.

Never Broke Again!

Before we jump into the ways to save money when you are broke, let’s start with some motivation.

If you are broke now you must understand that it is a temporary state that you can change. You must change the way you think before you can change your financial situation.

Grab a tissue and listen to this emotional story from Lisa Nichols. It will change your life.

How to Save Money When You’re Broke

After listening to Lisa’s super motivational story, you should be super inspired and ready to start saving.

Here are a few steps to take to start your savings journey.

Open a Savings Account

The first step to saving money when money is tight is to open a savings account. This allows you to separate your spending money from the money you need to save.

Separating your money gives you a clear visual of your savings. It can also make it more difficult to access your savings in case you are tempted to spend it.

If you do not have access or do not like banks you can choose another method of separating your money. The goal is to keep the money you are saving in a secure place that is totally separate from the money that you use for day to day living.

Create a Budget

The second step to saving money when you are broke is creating a budget.

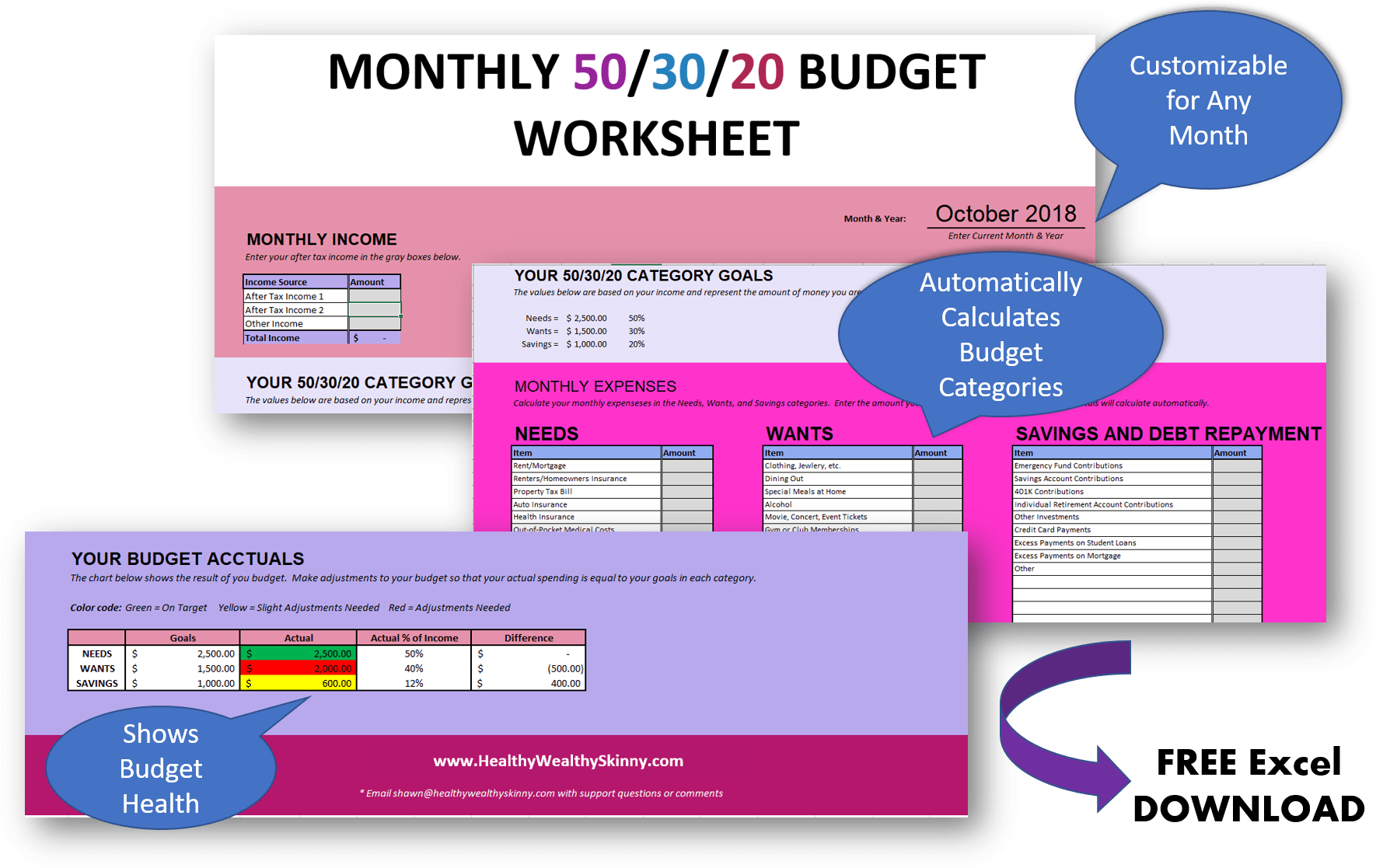

A budget will give you a clear picture of what your expenses are and how much you will have to save each month.

Creating a budget is an essential step in managing your personal finances. And with the right tools, they can be simple to create and manage.

Download a copy of our free Monthly 50/30/20 Budget Worksheet. It’s a free excel spreadsheet to help you create and maintain your budget.

Set a Savings Goal

After you have a full understanding of your finances, it is time to set a savings goal.

Determine the exact amount or percentage of your income that you would like to save. This will give you a hard target that you must adhere to.

Use your budget to determine a daily, weekly, or every two weeks savings goal. Most often your saving frequency will line up with your paydays.

This will make it easy for you to set aside your savings immediately when you get paid.

When you initially start learning to save money, the amount you save isn’t important. You need to get yourself into the habit of saving.

Don’t worry if you don’t have a lot of money to save. Saving as little as $5 doesn’t sound like much.

However, it will put you in the mindset of saving and allow you to find it easier to save more money when you have it available.

Related Post: 52 Week Money Challenge – Start a Year of Saving

Limit Spending

A major part of saving money is having money to save.

Your first step in freeing up more money in your budget is to limit your spending. This means spending wisely on the items that you need to live.

When it comes to your living expenses, ensure that you are living as frugal as possible.

Make sure you are getting the best deals on things like insurance and gas.

Also, ensure that you are not wasting money on utilities by leaving lights on unnecessarily or using excessive amounts of water.

You should also ensure that you are purchasing frugal foods and making frugal meals.

Eliminate Extras

Eliminating extras goes hand in hand with limiting spending. Extras would include anything that is not essential to your day to day living.

This includes cable TV, trips to the nail salon, gym memberships, music subscriptions, and eating out just to name a few.

Most of these items are causing you to spend unnecessary money anyway. For example, you can get a great workout at home without any equipment needed.

Take an inventory of the extras that you have in your budget and decide what needs to be cut.

I don’t recommend eliminating all extras as making yourself too uncomfortable will cause you to abandon your savings goals.

For example, you can cut cable TV and keep a subscription to Netflix.

Netflix is an extra however if you don’t have any entertainment at home you might be tempted to go out to dinner and the movies causing you to spend more money.

Related Post: 8 Ways to Watch TV without Cable or Satellite

Get a Side Hustle

Another way to have more money to save is to get a good side hustle.

A side hustle is a way to make money outside of your main job. You can do this by getting a traditional part-time job or by creating your own side business.

There are multiple ways to make extra money online or by doing needed tasks in your

Side hustles can help you get through times when spending extra money is required like birthdays and holidays. During these times you do not want to stop saving money as scheduled.

You also do not want to tap into your savings to buy gifts. A side hustle is just what you need to make the extra money you need for any holiday or special occasion.

Here are a few ways you can make extra money before Christmas.

The money from your side hustle can be used to increase the amount that you save or to help with unexpected expenses. Don’t make the mistake of spending more because you are bringing in extra cash.

Sell Stuff

Finally, selling unwanted and unused items is a great way to gather up extra money to save.

There are tons of websites and apps available that make selling your stuff easy and most importantly safe. Utilize sites such as the Declutter, the Facebook marketplace, Letgo, Offer Up and eBay.

Saving is Hard But Doable

Saving when you’re broke is hard but it is definitely doable.

Make up your mind that you are going to start saving, figure out your savings goal, watch your spending, and work on bringing in extra money.

With these

Leave a comment and share some of the ways that you save money even when money is tight.

Don’t forget to Like, Share, Tweet, and Pin this post.

I’ve been trying to save up for such a long time and i keep stalling! I’m about to!

It’s really a mindset thing Sofi. Once you make the decision and get a plan it really starts to work.

These are great tips. A lot of these are also goos tips for saving in general ?

Thanks Lucy!

Great tips, common sense really but maybe not for all!

You’d be surprised Marijke. When you’re focused on day to day survival it’s hard to think about saving money. It’s not an easy task at all.

Great tips! I definitely need to go through our storage and find out what we could sell!

Thanks Cassie! I’m sure you’ll find some great things to sell.

An excellent post! Setting your intentions and learning your habits underpins all of this. Thank you for sharing!

Thanks Charlotte!

I love this post! We’ve been working on our credit in order to buy a house, so these tips on making more money are just what I need.

Thanks Erica. Good luck on buying your house!

Excellent tips for saving money on a consistent basis. What I’ve learned over the years is like the famous slogan from a Nike ad (‘Just Do It)…and something that my Uncle told me years ago, he said, ” pay yourself first!” )

Thanks Ronald! I agree with both Nike and your Uncle. ?

Making a budget is the most important thing you can do. With out a budget you really don’t know how much you are spending therefore you really don’t know if you have any money to save or not.

After you have a budget and you are living on it. You will probably see where you were you had been wasting money in the past.

Great article

So very true Douglas! It’s almost impossible to know what your working with and if you are over looking bad habits if you don’t have a budget.

These are great tips that seem simple, but are just the type of things that have to be articulated for a person like me lol if that makes any sense! Also, I tried the link for the Lisa Nichols video but it said the video was unavailable. Do you have another link or the title so I can look it up?

Brittany, thank you so much for letting me know the video was down. It is definitely a must see! I’ve found another copy and updated it in the post. You can also go on YouTube and Search “lisa nichols never broke again”. There are a lot of channels that are carrying it.

A piggy bank helps. We put every £2 coin we got in the change into a piggy bank. A tin. When it was full we bought a sofa from it.

Piggy banks are great ways to save. We save coins as well. We are always so surprised at the amount of money you have once you fill a piggy bank.

I like to down play my paycheck. If my paycheck is $423. I write down that I got $400. And pay bills with that. I keep a running total of paychecks in what I pay goes out. Amazing when you don’t see it you can go into your bank account and see extra money. When I have more then $100 more then expected in my checking I transfer it over to savings.

Thanks for sharing Jackie! That sounds like an awesome technique. I like this method of putting a little each paycheck out of sight so you don’t think about it.