Have you wondered how to start an emergency fund? Savings vs emergency fund? What ‘s the difference and how to build your savings fast. If you are managing your personal finances these are questions you may have asked yourself.

Including where to park emergency fund and should you use high yield liquid accounts. Find out the basics of setting up your emergency fund fast.

Note: This page contains affiliate links, which means that if you buy something using one of the links below, I may earn a commission.

Savings vs Emergency Fund

An emergency fund is one of the major building blocks of your financial structure. Budgeting and paying off debt are great strategies. They require hard work and dedication.

But what happens when the unthinkable happens?

One bad situation can erase all of your hard work and planning if you don’t have money in place for emergencies.

What is an Emergency Fund?

An emergency fund is money that is saved to help pay for large unexpected expenses. The goal is to have money set aside to cover the costs experienced in an emergency situation.

This can include things like:

- job loss

- medical emergencies

- car accident

- car repairs

- home repairs

- family emergencies

No one wants to think of any of these types of things happening to them. However, it’s best to be prepared financially just in case they do.

What are the benefits of having an emergency fund?

Having a properly funded emergency fund is important for many reasons. It ensures that you can cover the expenses of an emergency without damaging your finances.

You are more likely to max out your credit cards or take out high-interest loans as a result of an emergency. These actions are detrimental to your financial wellness as they increase debt.

It is recommended that you have an emergency fund in place as you work on decreasing your debt.

This ensures that you are able to stay on track with reducing your current debt, without incurring new debt when unexpected life events happen.

How much money should you have in an emergency fund?

You’re starter emergency fund goal should be $1000. However, financial experts have many different opinions when it comes to how much money you should have in your emergency fund.

Most agree that you should have at least 3 to 6 months of your living expenses saved up in your emergency fund.

Note: This means that you need to be aware of your monthly living expenses.

Some financial experts believe that you should have at least 12 months of living expenses saved in your emergency fund.

This ensures that you and your family are covered for things like medical emergencies that will stop you from working or the loss of your job.

You should choose the amount you save in your emergency fund based on your circumstances. Consider things like your job stability, if you have a working spouse or partner, and if you have kids.

If you are the primary supporter of your family then you should have more saved. Compared to someone single who simply needs to cover her own needs.

How to Start Your Emergency Fund

Starting your emergency fund consists of making a few key decisions:

- Where will you save your money?

- How much money do you need to save?

- How will your build your savings?

Decide Where to Keep It

Deciding where you want to keep your emergency fund is an important step. There is no one best location for every one.

Like most things the place where you decide to store your savings is unique to you. There are, however, a few common locations that many people use.

High yield savings accounts like this are one of the most popular places to store your emergency fund. It allows you to get to your money easily and earn interest.

When choosing a savings account for your emergency fund be sure that there are no monthly maintenance fees and no balance requirements.

Other places to keep your emergency fund money include money market accounts, CDs, or even a simple checking account.

When choosing where to store your emergency funds ensure that your money is easily accessible in case or an emergency. However, it is best to keep it separate from you other money so that you are not tempted to use it for other purposes.

Understand Your Finances

Your next step is to understand your finances. This includes knowing how much you spend money on expenses and how much income you have from various sources.

Without knowing these things it will be hard for you to determine the goal amount that you need to store in your emergency fund.

Look at your budget (create one if you don’t already have one), and determine how much money you need to cover 3 months living expenses, 6 month living expenses, and 12 month living expenses.

Depending on your situation, choose one of these as your fully funded emergency fund goal.

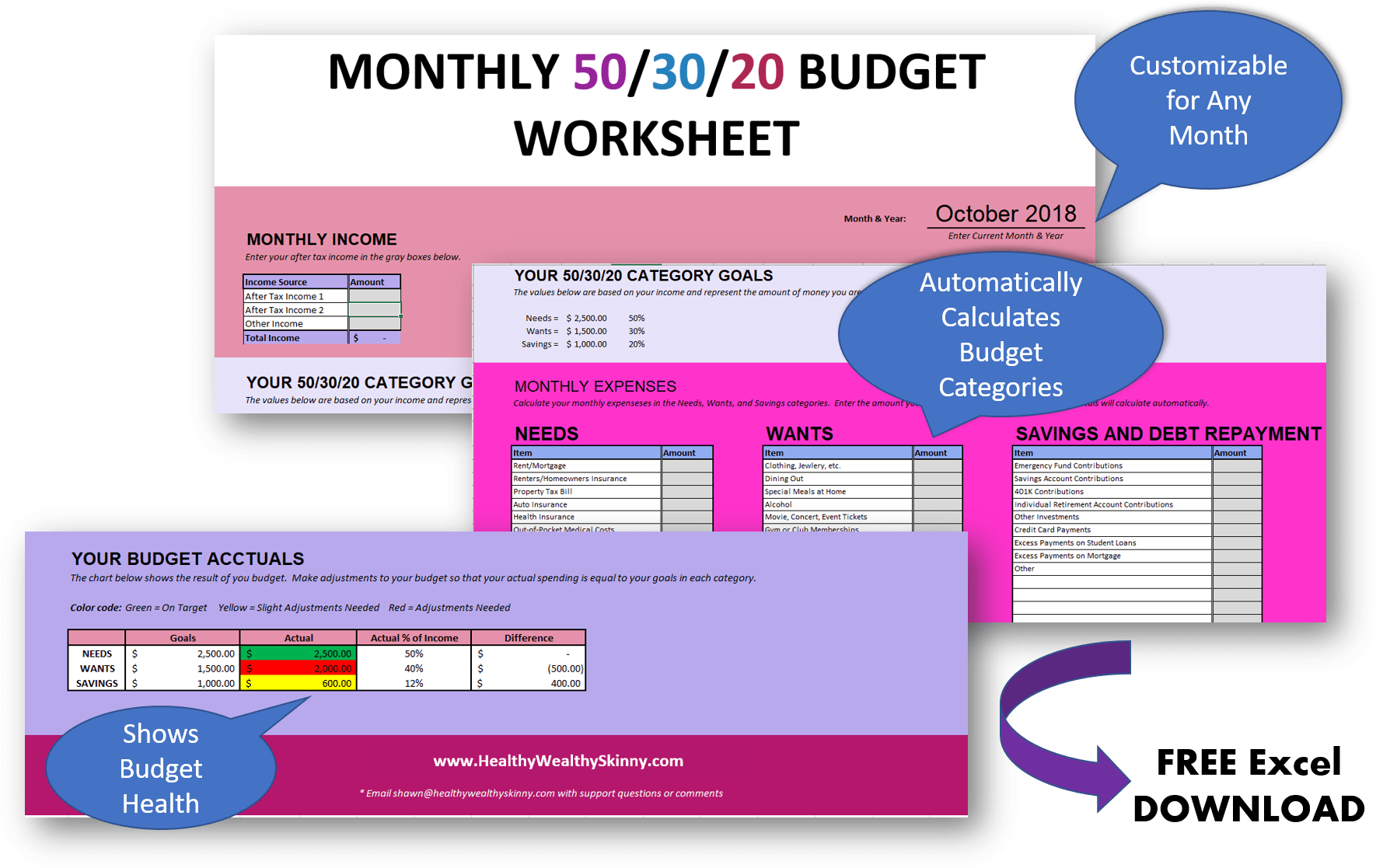

Download a copy of our free Monthly 50/30/20 Budget Worksheet. It’s a free excel spreadsheet to help you create and maintain your budget.

Start Saving

There’s nothing left to do now but start saving. You know where to put your money and how much you need to save.

The final step is using one of the methods below to start accumulating money that you can save to build your emergency fund.

Fast Ways to Save $1000 for Your Emergency Fund

Although you eventually want to have 3 – 12 months worth of living expenses saved up in your emergency fund you have to start somewhere.

Here are a few ways to save your first $1000 for your emergency fund.

Start a Savings Challenge

A savings challenge is a great way to motivate yourself to save more money.

If you are already using this method for your regular savings or to save for a special event, you can simply start another challenge specifically for your emergency fund.

Get a Side Hustle

Side hustles are great ways to bring in extra money to save without making any changes to your current budget.

There are multiple activities that you can do online from the comfort of your own home that can bring in extra income. You can even take a hobby or skill that you have and sell handmade items on Etsy.

Live Frugally

You may be able to find extra money in your budget by just decide to live frugally. This doesn’t mean going without. It simply means being smart with your money.

Frugal living tips like these can help you save more money just by spending wisely. You’ll quickly start saving on utilities by switching electricity companies, groceries, and even clothes.

Sell Your Stuff

Selling my unwanted items is one of my favorite ways to make extra money. This is a quick an easy way to build your emergency fund fast.

All you have to do is find unused and unwanted clothes and items around your house and post them on sites like LetGo, OfferUp, and the Facebook Marketplace.

Save Spare Change

This might sound very basic, but saving spare change is an easy and unbelievably efficient way to save extra money.

There are two great ways to save change. The method you choose depends on if you are a cash spender or debit card swiper.

If you normally use cash, simply place your leftover change into a savings container at the end of the day. Once the container is full deposit the funds into your emergency fund account.

For people like me who are more comfortable with making purchases using a debit card, there is another way to save

You Need a Safety Net

No matter how adventurous you are don’t manage your finances without a safety net. An emergency fund is there to catch you and protect your financial health if anything goes wrong.

Do you have an emergency fund? Leave a comment and share how you built it.

Don’t forget to Like, Share, Tweet, and Pin this post.

President Trump’s partial shut down of the federal government has did more to drive home the importance of having an EMERGENCY FUND of a minimum of 3 to 6 months than all the “financial education sites” combined!

Hi Ronald, I completely agree. This is a perfect example of what an emergency fund is designed for.